Form 1099-MISC/NEC, W-2, 940 & 941 Deadline is

February 01, 2021. E-File Now

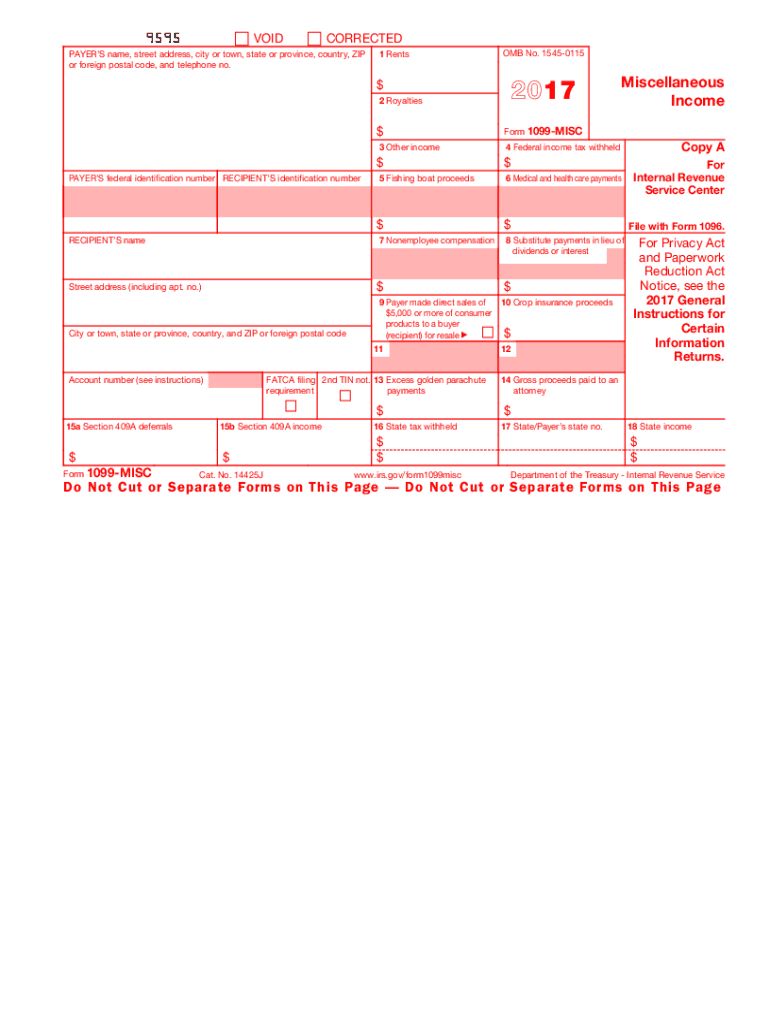

Miscellaneous Information. Department of the Treasury - Internal Revenue Service. This is important tax information and is being furnished to the IRS. Online for furnishing statements to recipients and for retaining in your own files. Section 6071(c) requires you to file Form 1099-NEC on or before February 1, 2021, using either paper or electronic filing procedures. File Form 1099-MISC. Order 1099 tax forms from Deluxe. Find the various 1099 forms you need including 1096 forms, 1098 forms, and others. Miscellaneous Income. For Internal Revenue Service Center. Department of the Treasury - Internal Revenue Service.

You can no longer report nonemployee compensation in Box 7 of Form 1099-MISC. If you want to report nonemployee compensation, you will have to file Form 1099-NEC.

Benefits of Filing Form 1099-MISC Online With ExpressEfile

Below are the best benefits you'll get when you E-file Form 1099-MISC through ExpressEfile.

Instant Filing Status

Get instant email notifications on the return status as soon as the IRS processes your

1099-MISC returns.

In-built Error Check

Our in-built audit check

will analyze your tax

return for basic errors,

so there is a lesser chance

of rejection.

Postal Mailing

Opt for the postal mailing option and let us send the copies of Form 1099-MISC to your recipients on

your behalf.

Email Copies

Send the return copies to

your returns by email

easily right from the application at no

additional charge.

File with confidence

How to File Form 1099-MISC Online?

Filing Form 1099-MISC online is so easy. You just have to follow the simple steps below.

Enter Information

Enter the form information such as payer and recipient info, miscellaneous payments made to the independent contractor.

Planet 7 casino log in. Planet 7 Casino strives to provide a safe environment for our players. We are GLI Certified to give players the best quality playing experience, and all transactions and activities are fully encrypted. We believe in responsible gambling – Planet 7 Casino.

Review Form

Review the draft form and make sure the information entered is correct. Update the information if you find

any mistakes.

Transmit the Return to IRS

If you find no mistakes, simply transmit the return to the IRS. You can then download or email the return copies from the application.

Start E-filing Form 1099-MISC. It takes less than 5 minutes.

Checkout the video tutorial to know how to E-File 1099-MISC with ExpressEfile.

Information Needed to E-File Form 1099-MISC

Here are the details required to file Form 1099-MISC online:

- Payer Details: Name, EIN, and Address

- Recipient Details: Name, EIN /SSN, and Address

- Federal Filing Details: Miscellaneous Income and Federal Tax Withheld (if any)

- State Filing Details: State Income, Payer State Number, and State Tax Withheld

If you have the above information ready, start filing Form 1099-MISC online.

E-File 1099-MISC NowCustomer Testimonials

Convenient and user friendly. Illegal casino long beach.

Its Easy to make and print forms!

Simply awesome. Never knew filing would be this much simpler.

The step by step instructions helped me to complete filing quickly.

Thank you so much for this excellent application. Loved it.

Completed my filing using the bulk option. It was really simple and easy.

Make the smart choice of e-filing with ExpressEfile

Frequently Asked Questions on Form 1099-MISC

Who must file Form 1099-MISC?

Payers who made miscellaneous payments of $600 or more to independent contractors in a calendar year must file Form 1099-MISC. The miscellaneous payments include rent, fishing boat proceeds, medical and health care payments, prizes, and awards.

When is the deadline to file Form 1099-MISC?

The due dates for 2020 Form 1099-MISC are as follows:

- Due to send recipient copies: February 01, 2021.

- Filing deadline for paper filing: March 01, 2021.

- Filing deadline for E-filing: March 31, 2021.

Online 1099-misc Form Free

E-File Form 1099-MISC with ExpressEfile and get the filing status instantly. Also, you can postal mail the recipient copies. E-File Now

Are there any penalties for filing Form 1099-MISC late?

Yes, the IRS will impose the penalties for not filing Form 1099-MISC. A penalty of $50 per form if you file Form 1099-MISC within 30 days after the deadline. In case you file the form after 30 days from the deadline, the penalty will be increased up to $100 per form.

The reasons for penalties include

- late filing

- filing a 1099 paper form that's not machine-readable

- Using the form for the wrong year

- Not using the right copy of Form 1099-MISC

- Filing with incorrect or missing TIN or reporting incorrect information

Helpful Resources for Filing Form 1099-MISC

Online 1099 Misc Template

You can no longer report nonemployee compensation in Box 7 of Form 1099-MISC. If you want to report nonemployee compensation, you will have to file Form 1099-NEC.

Benefits of Filing Form 1099-MISC Online With ExpressEfile

Below are the best benefits you'll get when you E-file Form 1099-MISC through ExpressEfile.

Instant Filing Status

Get instant email notifications on the return status as soon as the IRS processes your

1099-MISC returns.

In-built Error Check

Our in-built audit check

will analyze your tax

return for basic errors,

so there is a lesser chance

of rejection.

Postal Mailing

Opt for the postal mailing option and let us send the copies of Form 1099-MISC to your recipients on

your behalf.

Email Copies

Send the return copies to

your returns by email

easily right from the application at no

additional charge.

File with confidence

How to File Form 1099-MISC Online?

Filing Form 1099-MISC online is so easy. You just have to follow the simple steps below.

Enter Information

Enter the form information such as payer and recipient info, miscellaneous payments made to the independent contractor.

Planet 7 casino log in. Planet 7 Casino strives to provide a safe environment for our players. We are GLI Certified to give players the best quality playing experience, and all transactions and activities are fully encrypted. We believe in responsible gambling – Planet 7 Casino.

Review Form

Review the draft form and make sure the information entered is correct. Update the information if you find

any mistakes.

Transmit the Return to IRS

If you find no mistakes, simply transmit the return to the IRS. You can then download or email the return copies from the application.

Start E-filing Form 1099-MISC. It takes less than 5 minutes.

Checkout the video tutorial to know how to E-File 1099-MISC with ExpressEfile.

Information Needed to E-File Form 1099-MISC

Here are the details required to file Form 1099-MISC online:

- Payer Details: Name, EIN, and Address

- Recipient Details: Name, EIN /SSN, and Address

- Federal Filing Details: Miscellaneous Income and Federal Tax Withheld (if any)

- State Filing Details: State Income, Payer State Number, and State Tax Withheld

If you have the above information ready, start filing Form 1099-MISC online.

E-File 1099-MISC NowCustomer Testimonials

Convenient and user friendly. Illegal casino long beach.

Its Easy to make and print forms!

Simply awesome. Never knew filing would be this much simpler.

The step by step instructions helped me to complete filing quickly.

Thank you so much for this excellent application. Loved it.

Completed my filing using the bulk option. It was really simple and easy.

Make the smart choice of e-filing with ExpressEfile

Frequently Asked Questions on Form 1099-MISC

Who must file Form 1099-MISC?

Payers who made miscellaneous payments of $600 or more to independent contractors in a calendar year must file Form 1099-MISC. The miscellaneous payments include rent, fishing boat proceeds, medical and health care payments, prizes, and awards.

When is the deadline to file Form 1099-MISC?

The due dates for 2020 Form 1099-MISC are as follows:

- Due to send recipient copies: February 01, 2021.

- Filing deadline for paper filing: March 01, 2021.

- Filing deadline for E-filing: March 31, 2021.

Online 1099-misc Form Free

E-File Form 1099-MISC with ExpressEfile and get the filing status instantly. Also, you can postal mail the recipient copies. E-File Now

Are there any penalties for filing Form 1099-MISC late?

Yes, the IRS will impose the penalties for not filing Form 1099-MISC. A penalty of $50 per form if you file Form 1099-MISC within 30 days after the deadline. In case you file the form after 30 days from the deadline, the penalty will be increased up to $100 per form.

The reasons for penalties include

- late filing

- filing a 1099 paper form that's not machine-readable

- Using the form for the wrong year

- Not using the right copy of Form 1099-MISC

- Filing with incorrect or missing TIN or reporting incorrect information

Helpful Resources for Filing Form 1099-MISC

Online 1099 Misc Template

E-File your Form 1099 MISC in minutes and postal mail recipient copies.

Online Filing 1099 Misc 2019

Pricing starts as low as $1.49/form